Does The Bank Keep A Copy Of Money You Wired

Prepaid debit card accounts like Netspend are popular for many reasons. Consumers often desire to eliminate the take a chance to their personal bank accounts by paying for purchases with prepaid debit cards. These cards only have access to limited funds — the corporeality you choose to deposit — rather than the total corporeality in your bank account. In other cases, consumers demand to reestablish a positive banking history before they can open up a traditional banking company account, or young adults employ them to control their spending while they acquire how to manage their money.

Online shopping and many other types of purchases require a debit or credit menu, which makes some type of payment card a necessity in today's world. As a debit card with either the Visa or Mastercard logo, Netspend cards allow y'all to deposit as much or as little every bit you lot want, giving you the freedom to brand carte du jour-just purchases with a quick swipe. Here's a quick look at how Netspend works hand-in-hand with your bank account.

Use Your Netspend Business relationship to Pay for Purchases

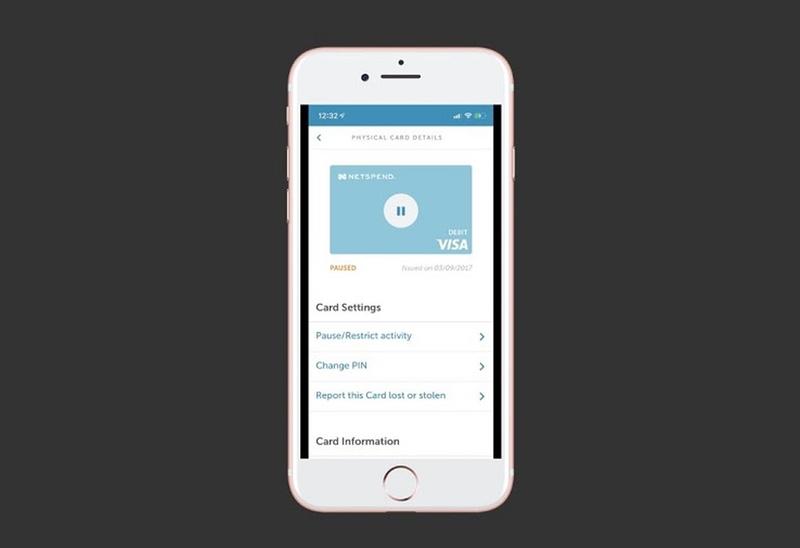

Netspend provides customers with prepaid Visa or Mastercard debit card accounts without charging activation fees or requiring credit checks and minimum balances. Unlike prepaid debit gift cards, Netspend prepaid debit cards are attached to accounts with your proper name and accost associated with them. The cards have your name printed on them along with an expiration date and security code, just like credit cards.

Although they operate a lot like credit cards, Netspend cards do non crave a hard credit inquiry for approval, but you do accept to verify your identity to receive a carte. In add-on to manually calculation funds to the carte du jour, you tin fix direct deposits into your Netspend business relationship to give you quick access to paycheck funds via your card.

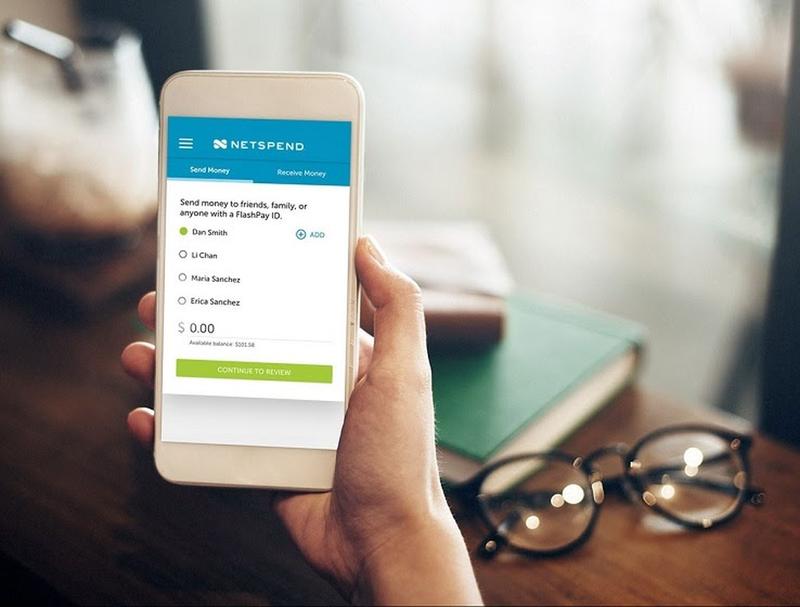

Send and Receive Coin with Netspend

One time you set up a Netspend account, you tin can also send and receive coin between Netspend, ACE Elite, Control and Purpose cardholder accounts. Y'all can do this in several means, including by setting upwardly directly deposits and quick coin transfers using FlashPay IDs.

If you lot accept a PayPal account, you can transfer coin from your PayPal account to your Netspend card and vice versa. For easy transfers, download the Netspend app and link the two accounts together in the Netspend app and in the PayPal app. Once you complete those steps, you can send and receive money from your PayPal account and use your Netspend card as a payment source for PayPal. Depending on your Netspend business relationship, yous may also be able to ship and receive money using wire transfers through Western Union.

Transfer Money to Your Bank Account

Netspend prepaid debit cards are generally used to make purchases, which means it's more common to transfer money out of your banking company account to your Netspend menu using the website or a mobile app. You link your accounts when you set up your Netspend account to enable instant transfers from your banking company to Netspend. Notwithstanding, you can likewise transfer money out of your Netspend business relationship to your depository financial institution business relationship — with a little extra effort.

The workaround is simple, although it takes a few actress steps and perchance a few extra days. If your PayPal business relationship is linked to your bank business relationship, you tin can transfer funds from your Netspend account to your PayPal account and so transfer the funds from your PayPal account to your bank account. This process could only have minutes if PayPal doesn't put a agree on the funds from Netspend, and you utilise the instant transfer option on PayPal (for a fee) to transfer the money to your depository financial institution. Otherwise, it could take several days to consummate all the transfers.

Make certain you understand the rules and associated fees for making transfers at all three institutions: Netspend, PayPal and your depository financial institution. Some banks and financial institutions take daily transfer limits likewise equally fees for transfers, so making multiple transfers within a curt time frame or transferring large sums within a brusk time frame could result in fees. Check with your financial institution before making any transfers.

Source: https://www.askmoney.com/investing/transfer-money-from-netspend-to-bank-account?utm_content=params%3Ao%3D1465803%26ad%3DdirN%26qo%3DserpIndex

Posted by: robertscatill93.blogspot.com

0 Response to "Does The Bank Keep A Copy Of Money You Wired"

Post a Comment