How To Transfer Money From Bofa Acct To Another Bank

Disclaimer: This mail may contain affiliate links or links from our advertisers where we earn a commission, direct payment or products. Opinions are the writer's alone, and this content has not been provided by, reviewed, approved or endorsed past whatsoever advertiser. Information shared on this site is for entertainment purposes only and should not be considered equally professional communication.

Not sure what to exercise after yous pay off your mortgage?

There are some important hoops y'all have to jump through to make this momentous occasion official. Subsequently all that hard piece of work in paying your mortgage, let'southward brand sure yous cross all your "T's" and dot your "I's". The mortgage payoff procedure can be confusing!

I went through all of these steps a few years ago when our family paid off our mortgage early. It was surprising to me how many steps were required to simply pay off a freakin' debt. All the same, we followed the "rules" so we never had to practice it once more!

Here are ten steps that I went through for our mortgage payoff procedure.

1. Request a Mortgage Payoff Argument

I thought nosotros could merely send in the last mortgage payment and we'd be all set. Nope! Evidently, yous need to call your mortgage company and verbally request a "mortgage payoff argument".

A mortgage payoff statement is a document that details your loan residue – how much you owe on your mortgage.

Brand this a fun moment for yourself! This is the first time yous get to say to someone from your mortgage visitor, "We'd like to pay off our mortgage today!"

Don't exist surprised if the representative isn't equally enthusiastic as you are most it. Our rep was helpful and congratulated us on the big moment in our lives, but I could tell she wasn't doing a happy dance similar I was.

During your phone conversation, you'll choose a "Pay Off Skillful Through Date". This substantially ways that you'll demand to send in your last payment prior to this date to not incur further interest charges. For reference, we fabricated this phone call at the first of the calendar month and set our "Pay Off Good Through Date" for the cease of the calendar month.

2. Pay the Mortgage Payoff Statement Fees

Depending on your state, there may be extra fees included in paying off your mortgage. For usa, we had to pay a $30 "statement fee" and a $fourteen "recording fee".

Ane last poke in the side from the mortgage company earlier they grant your freedom!

Here'southward the mortgage payoff statement I received from my provider "Liberty Mortgage".

three. Obtain a Certified Check or Request a Wire Transfer

Mortgage companies may not accept a regular online payment or a personal check for the last payment. For us, we had the choice of either a certified bank check or a wire transfer.

We went to our local banking concern and requested a wire transfer. Information technology hit our business relationship almost immediately. When we got home from the bank, I checked online and it had a lovely $0 balance.

four. Ask About Your Escrow Residue

Depending on when yous pay off the loan, you volition more than probable have an escrow residuum containing funds for future payments to your homeowner's insurance and property taxes.

Ask your mortgage company about your escrow current remainder and how much you'll be receiving back. For us, we received a bank check for around $2,000 two weeks after we paid off the loan.

Don't go spending this money now! You're going to need it to pay these bills manually now.

five. Contact Your Homeowner's Insurance Provider

Now that you don't have an escrow business relationship anymore, yous'll need to pay your homeowner's insurance going forrad. For us, this was an opportunity for united states of america to maximize our travel rewards earnings by putting our almanac insurance payment on our credit card instead of paying through escrow.

Accomplish out to your homeowner'due south insurance provider and let them know that yous've paid off your mortgage and you'll exist making the payments going forward.

Enquire them about automatic billing options and then that you don't accidentally miss this important payment each year.

6. Contact Your City or Township Function

Merely like the homeowner's insurance, your property taxes were paid through escrow likewise. Now, you're in accuse of paying them.

Touch base with your city offices and let them know that yous've paid off your mortgage and you will now be making your property tax payments.

Our township had a convenient online payment system that was pretty impressive for a regime website!

7. Abolish Your Automatic Mortgage Payment

If you don't abolish your automatic mortgage payment for the upcoming month, you may accidentally pay more than yous intended. Sign in to your online account and ensure you're all set up.

This may audio light-headed, but based on some comments nosotros've gotten on this article, it can happen! When information technology comes to your coin, triple checking can make a big deviation.

8. Conform Your Budget Accordingly

Tracking your spending and saving is even more important now that you're mortgage gratuitous!

Program a sinking fund for your homeowner'southward insurance and your holding taxes in your monthly budget. Yous don't want these big-ticket items to surprise you down the route.

For budgeting our monthly expenses including our homeowner's insurance and property taxes, we love Mint. Too Mint, in that location are dozens of other online budget apps that volition help you keep track of your household expenses.

This is also a time to make some big decisions most this newfound money.

After Paying Off the Mortgage, What'due south Next?

Since my married woman and I were making actress principal payments, we had an extra $2,300 to spend in our start month of mortgage liberty. It was a scrap overwhelming for u.s.!

We decided to classify our extra coin in the following means:

- Save upward for our get-go rental property

- Increase our charitable giving from 1% to 5% of our subsequently-tax income

- Open up and fund a Health Savings Account (HSA) for hereafter health care expenses

- Update our kitchen

- And vacation a lot more than!

9. Receive an Official Alphabetic character from your (former) Mortgage Provider

Around 30 days afterwards you make your concluding payment, you'll receive an official letter from the mortgage company stating that your loan is paid in full.Yous'll desire to keep this one for your records.

Or you lot could frame it like we did. Frame or no frame, make sure you save information technology just in example.

x. Obtain the Mortgage Release Documents

Your mortgage visitor volition produce "mortgage release documents" that prove the mortgage is no more. Be sure to speak with your lender to understand when these documents will be sent to your County Clerk for processing.

You should too receive a copy of these documents that yous'll keep for your records. Depending on your specific situation, you may need to go to the County Clerk to get a copy yourself.

FAQ on What to Do Later on You lot Pay Off Your Mortgage

Since writing this article a few years ago, I've received a lot of questions and comments (below). It helps a lot for other people who are paying off their mortgage to read this data and so feel costless to add information below to help others as they are making their mortgage freedom official.

Here are a few of the recurring questions that accept come up:

Okay, I paid off my mortgage. How do I prove that I ain the house?

When you lot purchased your domicile originally, you should accept a document called a "Warranty Deed". Your notarized warranty deed is proof of ownership for your habitation.

Other ways to prove that y'all ain your home are as follows:

- A Satisfaction of Mortgage Letter

- Documentation showing that no mortgage company is associated with your homeowner's insurance

- Producing a re-create of your Schedule E from past personal taxation returns (showing that you're not taking the mortgage interest deduction)

Practice I have to utilize a wire transfer or banking company check to pay off my mortgage officially?

This all depends on your depository financial institution, your lender and your specific situation.

In the comments below, yous'll observe some people were able to use ACH to make their terminal payment while others (like me) had to go with a wire transfer.

Make contact with your mortgage provider and ensure yous understand the proper steps to follow to make this mortgage payoff official!

What are the fees and costs associated with paying off my mortgage?

Those fees vary depending on your state and your unique situation. In this article, we've seen fees between $forty-$260 for fees such as:

- Recording Fee

- Statement Fee

- Calculated Interest

- Reconvey/Release Prep Fee

- Expedite Fee

- Canton Recording Fee

Exist certain to ask ahead of time what fees y'all should await in the mortgage payoff process. Even if you lot're months abroad, calling your mortgage lender ahead of time and starting that conversation can't hurt.

Last Thoughts on What to Do After Yous Pay off Your Mortgage

Afterward all of these steps, brand sure you celebrate this HUGE mortgage-free moment with your loved ones. Some people live with mortgages for their entire lives … non you. You're mortgage free!

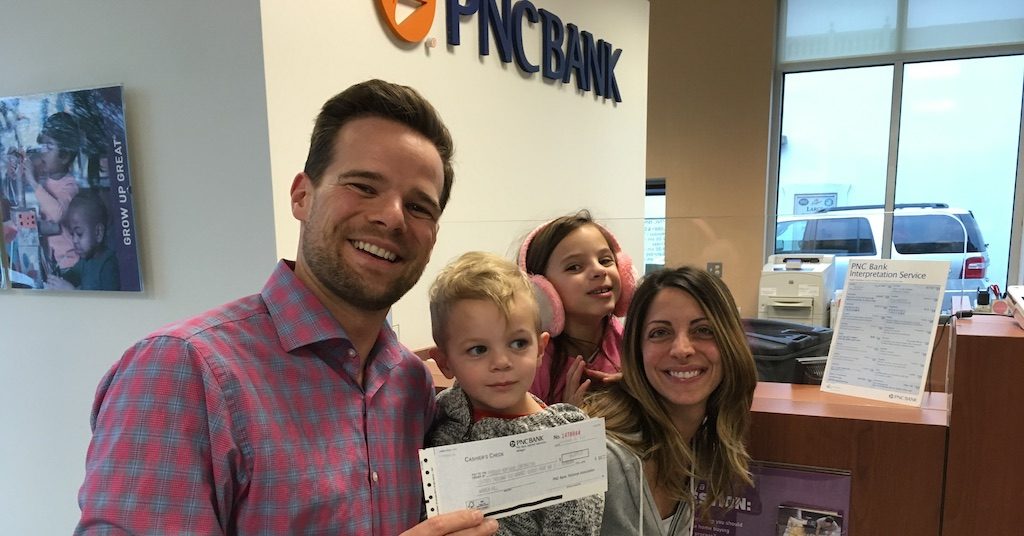

Hither's how our crazy family celebrated:

Are you lot figuring out what to do after paying off your mortgage?

Please let us know in the comments beneath. There are a quite a few other folks just similar y'all in the comments section.

Source: https://marriagekidsandmoney.com/ready-pay-off-mortgage-remember-important-steps/

Posted by: robertscatill93.blogspot.com

0 Response to "How To Transfer Money From Bofa Acct To Another Bank"

Post a Comment